- Belgium comes to Yamashita Park

- Residential Villa in Phuket Entices Remote Workers With Long-Stay Rates

- Rare pieces of French glass art at the Mirai Museum of Art

- Feast on fresh fish and seafood at the 2024 ‘Sakana’ Festival

- Would you like to ride in a Louis Vuitton gondola lift?

- Naked Snow Aquarium

- Festive lights at Yomiuriland will get you feeling the holiday vibes

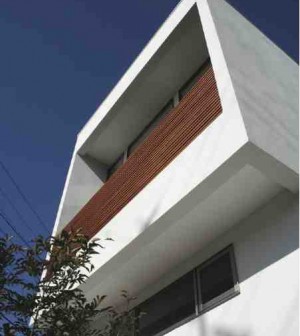

NESTING: the big issue What you need to know when building a house in Tokyo

Housing is a big issue whichever way you look at it. We want our “nests” to be the place where we, and each of our family members, most want to be.

Our choice of residence affects the mental and physical well-being of the whole family. In a city such as Tokyo, rental is the norm and our nests don’t always entirely match our true homing instincts. Restrictions on design, decoration and space can be extreme, and the freedom to create one’s own space is often denied.Now one can find new houses and apartment buildings sprouting up throughout the city, offering city living that rivals any foreign location, and in many cases surpassing it in terms of value, location and design. When considering aspects of schooling, safety and opportunities, Tokyo ranks right up there as one of the most desirable cities to live in, and now buy in. A house is a financial asset and more: it’s a place to live and raise children, a plan for the future. Many don’t realise that now house ownership in Japan is within their grasp.

PUTTING DOWN ROOTS

Once the exclusive domain of the super wealthy, the very notion of purchasing was almost unthinkable. Tokyo, whilst being one of world’s most advanced cities in aspects of commerce and technology, remained something of a backwater for home ownership and property investment on a personal level. However, now the doors are well and truly open, with domestic financing and permanent residency no longer being stumbling blocks. The only thing stopping you from purchasing is your desire, your distaste for Japanese red tape and of course, finances. Buying in Japan is now much like buying in your home country; there are pitfalls and potential dangers, but the rewards can be great.

THE GROUND RULES

Buying in Japan is of course a huge commitment financially and psychologically; it ties you to this country. Buying in Tokyo can be a good long-term investment–it doesn’t necessarily offer short term rewards in the same way as flipping property overseas, due mostly to the price of land. All kinds of property is available: new, old, repossessed, renovated, etc. Pricing varies enormously, but once you have spent some time in front of the computer, you can get to grips with the pricing policy. Within the 23 wards, there are no real bargains to be had, but you can still buy a house within 20 minutes of the centre of Tokyo for less than the London or New York equivalents. However, houses have a much shorter lifespan than elsewhere, on average 25-35 years. Traditionally, Japanese families knock down the old house and rebuild on the same land within this time frame. It is the land that you are paying for; construction prices are relatively reasonable. Land prices vary enormously, centrally located land is obviously at a premium. No real surprises there, the age-old adage rings true: location, location location.

EASY OPTIONS

Purchasing an apartment is, for many, the easiest option. Many developers are in partnership with financial institutions, so loans are often tied in and sourcing and financing can be a one-stop deal. Be aware, however, that on top of your monthly mortgage repayments, there are escalating extras such as monthly maintenance and parking fees. Often, apartment developers scale these payments to make the initial purchase more affordable; 10 years down the line is another story. Having said that, the design can be excellent and architects go out of their way to build innovative and stylish accommodation for you with a wide range of materials and excellent finishing.

BUYING A HOUSE IN JAPAN?

THE TRUE STORY

After a decade of painfully expensive rental in Omotesando, we found ourselves running short of space as our two girls grew at an alarming rate. In the final year of our rental agreement, we decided to examine the possibilities of purchasing. We were only too aware of the difficulties facing foreigners when trying to obtain a housing loan. Undaunted, we set about searching using the Yahoo! property search and spent the next weeks hunched over the computer into the wee hours searching for suitable properties within our price range. We quickly mastered the pricing system that is closely dictated by criteria based on square meterage, distance from station, train line and post code.

Initially we had focused on apartments, as this seemed the most feasible option. Our initial property hunting experience involved entering one of the huge showrooms for one of the big waterside developments in Shinagawa. We joined the conveyor belt sales tour that showed prospective buyers model apartments, model wall finishes, model floor finishes – you name it, there was a model for it. The question was, were we ‘model’ buyers? The answer of course was ‘no’, but this didn’t stop the salespeople from supplying unlimited soft drinks for the children who were already realizing that house-hunting could prove to be a fun experience and were more interested in the choice of beverage than the size of their new bedrooms. We were whisked into bathrooms with whirlpools, shown marble tiles and Scandinavian bleached oak flooring, and before we knew it, we were looking at available units on the ear-popping, wallet-breaking 42nd floor. We went home and mulled over location, and dreamt of the floor-to-ceiling glass windows and island kitchen. A far cry from our apartment at the time.

Encouraged by the sales momentum, we now found ourselves well and truly in the ‘buying game’. We made the first of many lists regarding our housing options: location, size, price and parking. One agent we contacted recommended viewing houses as the size-to-price ratio was more cost-effective than many of the new apartments.

We soon found ourselves being driven around viewing some horrendous properties. but nevertheless we were house-hunting in Japan with a Japanese realtor only weeks after taking the plunge. We made our own print-outs of the properties we liked in the area. If the properties weren’t on our realtor’s books, contacted the sellers. A commission is a commission, after all. We looked at some appalling residences; places that were essentially cubbyholes with ‘European styling’, mock ‘mock’-tudor frontages. Our realtor, seeing the look on our faces, realized we were after something different. From the conversation that transpired, another housing option was thrown into the pot, that of building one’s own house on a designated plot of land.

THE BIG JUMP

We were shown a small plot of land. Surely this couldn’t be the piece of land the realtor had told us about on the phone, but judging by the floor plans in his hand, it clearly was. After the initial shock, the design won us over and we were introduced to the architect from a ‘hip’ firm. Instantly appealing and something that we had never dreamt was even a remote possibility suddenly became a reality with a little cost cutting in the design; the roof-top spa was going to have to wait! Before you could say, “NY loft living,” we were choosing cut away staircases, birch flooring and debating over Italian or German bathroom fittings for a house that was being built for our family. The house took shape remarkably quickly, and the whole buying process with excellent guidance from our bank and our realtor took approximately six months.

Having a beautiful contemporary house that happily fits the kids, the cat and the dog is a wonderful thing. It’s not quite a mews’ house in Chelsea but pretty close for a city where we thought we would be eternal renters. Light, airy, ultra modern; it suits our family down to the ground. When friends and family come to stay, which they do with greater frequency than before, they love it. We wouldn’t change it in a million years or at least for 35 years when our kids will no doubt knock it down and a new story will be told.

GAME PLAN

Decide on an apartment or a house. New apartment buildings can have state-of-the-art security but rising maintenance costs and extra parking fees.

Houses give you more space and freedom for your money but you have to pay higher taxes and are responsible for your own maintenance.

Think about your budget. Add a further 7% on top of the asking price to cover additional costs’.

Don’t be tempted to look outside of your budget. It will make the houses that you can afford less appealing. “For a little more we could…” Dangerous words.

Limited kanji and a basic knowledge of the specialist terms is all you need to navigate property web sites. Use Yahoo! Japan property search to start.

Visit many agents because the character of the realtor can make a difference. Some are enthusiastic and dynamic whilst others are complacent and verging on rude. Be warned.

All real estate agencies access the same property database, so if you find a realtor you like, stick with them.

You will have to compromise. Bye bye jacuzzi, hello extra storage space!

Language is a huge barrier, but with a good realtor who is patient, you can negotiate the complexities of the buying system.

As with everything in Japan, following the rules to the letter facilitates a swift and trouble-free process. ‘Give what is asked for and you shall receive’, whether it be the bank, the lawyer or the realtor.

Don’t be afraid to buy off the plan. View the land and then the architect’s office will take you on a tour of a similar house, etc. Buying off a plan allows you to personalise your house in terms of flooring, kitchen, finish and in some cases modify the construction.

Be aware that computer graphics make things look a lot bigger!

Once you agree to buy the property, you have to make a contract with the seller and pay a cash payment which serves as a refundable deposit.

Then it’s loan time. Details of the property you have chosen are sent to the lender who duly examines and casts a critical eye over your future abode and your personal finances. Then you have to wait for the bank’s decision (up to a grueling 2 months).

If you are refused, don’t give up, ask for specific details. Give it over to the realtor; a “no” isn’t always final. If you get the thumbs up, celebrate with your last bottle of Champagne for a while. It’s time to start economising.

Without permanent residence you’ll need a guarantor (Japanese) to proceed with the application. Once you have gotten over this hurdle, you’ll be spending every weekend mulling over interior books and flipping through the Ikea and Cassina catalogues.

You made it!

FINANCING JAPANESE PROPERTY

Before you start looking, it is possible to obtain ‘pre-approved’ finance. This may not only save much time, but it also enhances bargaining power and choice if your finance is in place.

Secondly, find a good real estate agent, clearly state your specific property objectives and clarify the agent’s reasons for recommending a unit. Only view properties which meet your preferences and be frank with feedback. If you are enthusiastic about your preferences, the agent should reciprocate.

If you want an apartment, it is generally considered that corner units on top floors are favorable both from a lifestyle point of view and for re-sale value. These units are usually quieter and have good light. Proximity to a train station is also considered important, again for your convenience and for re-sale.

If you can afford to buy land, you could also obtain finance provided you already have development plans in place to build on it. A mortgage can also be provided for the construction of the property.

Also clarify how long the property has been on the market, its original purchase price if you are buying secondary property, reason for sale, price per square meter, access, land entitlement (most apartments in Japan are freehold, but check) and the financial status of the resident’s association fund. Also check if plans are afoot to construct a new highway or buildings in the immediate vicinity.

If your objective is ‘buy-to-rent’, assess the property yield, price per ‘stub’, and price of similar units in the area. Whether buying for investment or for occupation, the timeframe over which you foresee owning the property may also have an impact. Capital gains tax is more penal if you sell the property within 5 years of purchase.

You may also need to compromise; higher price for a very good location, your desire for new or secondary property, unit-size, distance from station, etc. A longer walk to the station may be needed in return for a desired unit-size.

View as many units as possible, and don’t be pressured. Consider the above factors, ask a lot of questions but be prepared not to tick every box on your list of requirements. You should then be in a position to make a rational decision and a sound investment.

Freehold Jiyuhoyuken

Leasehold Shakuchiken

Loan pre-approval Jizenshinsa

Loan guarantor Hoshougaisha

newly built & nbp; Shinchiku

New house with land Tateuri

Built-to-order house Chuumon Juutaku

Housing development Bunjou-Juutaku

Detached house Ikkodate

Land w/pre-approved bldg. application Kenchiku-Joukentsuki

Land with no pre-conditions Jouken-nashi

Contract Keiyakusho

Explanation of contract Juuyoujikou Setsumeisho

Housing loan Juutaku Ro-n

Permanent residence status Eijuuken

Official stamp Jitsuin

Application form Kaitsuke Shomei

Stamp certificate Inkan Shoumei